There is much talk today about the housing crisis across California. While the crisis is real and complex, it is most often addressed in a piecemeal and somewhat simplistic fashion. The issues facing communities in California are not just about having affordable housing for anyone that wants to live in a specific community. Housing and all its related policy areas is a large, complex topic not solved easily.

Over these next few weeks, we will be discussing policy areas that impact housing decisions and supporting legislation, and which should be discussed whenever housing policies are made locally or at the state level. Part 2 is about economic disparities and the role that dynamic plays in the housing crisis; and it is about whether or not increasing the number of market-rate units will actually solve the housing crisis.

Underlying the housing crisis in California are critical economic factors that must be addressed before we can solve the housing crisis in a productive manner, regardless of how many houses we do or don’t build. The economic disparities in our society are growing and are destructive. Wages have not kept up with prices of consumer goods and the general cost of living, most particularly the cost of housing, both ownership and rental. Until that is productively addressed, a growing segment of our communities will never be able to afford a living space of their own.

What follows are some data snippets gleaned from a variety of sources from Reuters to the Bureau of Labor Statistics. They demonstrate that no matter how you define it or explain it, no matter your political perspective, wages and entry and mid-level salaries are not allowing reasonable or timely home purchase or rental in tight markets like the immediate San Francisco Bay Area.

“For example, to buy a median priced home in various areas of New York City, Brooklyn and Manhattan especially, or in the San Francisco metro area, a buyer needs to spend between 120 percent and 95 percent of the average wage on mortgage payments.” Reuters, March 24, 2016.

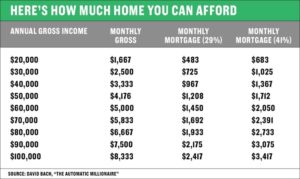

“…according to the Federal Housing Association, a good rule of thumb is that most people can afford to spend 29 percent of their gross income on housing expenses — as much as 41 percent if they have no debt,” Bach explains in his book, “The Automatic Millionaire.”

“Dramatically higher prices are partly why the typical homebuyer is now 44, whereas in 1981, the typical homebuyer was 25-34.” Emmie Martin, June 23, 2017.

“You’ll find the country’s most expensive rental markets in [San Francisco]. To afford a two-bedroom apartment, you’ll need to make at least $216,129 annually. While rental rates have increased in recent years, wages haven’t kept up. The median household income in the city is only $78,378.” Amanda Dixon, December 20, 2017. Percent change of a two-bedroom rental in San Francisco from 2015 to 2016 is 7.4%. Kathleen Elkins, August 15, 2016.

“Only 31% of SF households make more than $150,000 per year.” Derek Miller, February 20, 2018.

A January 19, 2016 report by Marian Tupy of reason.com demonstrates the complexities of analyzing the historical path of wages vs. cost of living. She makes a valid point that the “…expansion of non-wage benefits, fall in the price of consumer goods and rise in price of services, such as education and healthcare…” complicate the generally accepted data point that hourly wages have stagnated or declined since 1979. She further points out that the “average American” has seen certain “welfare gains” in the same period that should be included as part of the overall calculation, (e.g., “…houses are larger, healthcare better, and education more high tech…” than in 1979); and that In contrast, she also points out that “The cost of education, healthcare and housing has risen at a faster pace than total compensation.” What she fails to address in the totality of the calculation is that a vast majority of those on the lower end of the spectrum do not enjoy the “welfare gains” she identifies: they do not have access to healthcare except as might be accessed in an emergency room, are not privy to the “high tech education” opportunities, and cannot afford a house, larger or otherwise.

For a very good web-based presentation of the issues, check out CalMatters.

Taking all this into consideration, it is hard to argue that building more housing units will do much to allow lower wage earners and salaried workers to gain a better foothold on securing their own living space in their desired communities. True, more units on the market may cause a slight dip in pricing, but I would argue that such a dip will simply allow more high-wage/salaried earners to buy and/or rent in the desirable locations (i.e., provide opportunity to the pent-up, already-prequalified demand currently shut out of the market due to lack of inventory).

One could argue that at least more units will slow the thirst of landlords to seek higher and higher rents either at time of vacancy or by direct eviction of current tenants. However, I refer to the previous paragraph: more rental units will simply accommodate some, but not all, of the pent-up demand of the already prequalified renter willing to pay the higher prices because they can.

More units, built to address current market rate demand by their simple existence, will not provide affordable “workforce” housing to allow teachers and others to live in the communities in which they work, and to avoid the excruciatingly long commutes in which they are currently involved. A small number of “affordable” units as defined by HUD will not even make a dent in the population of lower wage earners and salaried workers desiring to move closer to their work.

It appears that the only way to comprehensively address the housing crisis, short of a tremendous recession in the housing industry, is with a comprehensive approach that makes housing prices overall more affordable, increases the inventory of available units, and increases the wealth of those at the lower end of the economic spectrum.

It depends a great deal on the political and philosophical priorities of those in elected office. If things are important like addressing global warming by controlling greenhouse emissions; having a healthy economically diverse community; perceiving value in having your teachers and other public servants live in the community in which they work; retaining young families in the community; reducing/eliminating homelessness…if these things are important, then the housing crisis must be attacked on multiple fronts including establishing an actual living wage for the area, quickly approving more housing units , partnering with banks and other financial institutions to structure workable financing for riskier lower income buyers, requiring and subsidizing higher numbers of affordable units, planning for and subsidizing workforce housing, equitably regulating rents, and developing comprehensive housing and social service programs for the homeless.

All good, but what is a living wage and for whom should it be paid? What are the elements of “homelessness” and how might communities address the issue? What right, if any, do communities have to limit the quantity of their residents? How do we reconcile unlimited growth with limited natural and essential resources like water? What role does quality of life play in communities and who defines it? Is higher density meant for every community? Are State-determined housing quotas working and are they realistic? Should government control the housing market place, and if so, how? How do we equalize education so that all children have access to a quality education and educational facilities? What is the impact of housing usurping open space and agricultural land?

On to Part 3.

Fran…will there be some suggestions at the end of this excellent review? Enjoying these blogs.

Working on it……Check out CalMatters at CalMatters.org

Filmizlesene ile hızlı film izleme fırsatını yakala, en yeni ve iyi filmleri Full HD 1080p kalitesiyle online ve bedava izle. Josef Sifford

https://mazda-demio.ru/forums/index.php?autocom=gallery&req=si&img=6332

https://mazda-demio.ru/forums/index.php?autocom=gallery&req=si&img=6397

https://myteana.ru/forums/index.php?autocom=gallery&req=si&img=6666

Awesome https://is.gd/tpjNyL

Very good https://is.gd/tpjNyL

Good https://shorturl.at/2breu

Very good https://shorturl.at/2breu

Awesome https://shorturl.at/2breu

Very good https://lc.cx/xjXBQT

Good https://lc.cx/xjXBQT

Awesome https://lc.cx/xjXBQT

Good https://lc.cx/xjXBQT

Good https://lc.cx/xjXBQT

Good https://lc.cx/xjXBQT

Good https://t.ly/tndaA

Very good https://t.ly/tndaA

http://terios2.ru/forums/index.php?autocom=gallery&req=si&img=4779

http://terios2.ru/forums/index.php?autocom=gallery&req=si&img=4786

Awesome https://urlr.me/zH3wE5

Very good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

https://vitz.ru/forums/index.php?autocom=gallery&req=si&img=5029

https://myteana.ru/forums/index.php?autocom=gallery&req=si&img=6840

Awesome https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

http://wish-club.ru/forums/index.php?autocom=gallery&req=si&img=5309

http://passo.su/forums/index.php?autocom=gallery&req=si&img=4271

https://honda-fit.ru/forums/index.php?autocom=gallery&req=si&img=7126

http://terios2.ru/forums/index.php?autocom=gallery&req=si&img=4647

https://mazda-demio.ru/forums/index.php?autocom=gallery&req=si&img=6359

https://honda-fit.ru/forums/index.php?autocom=gallery&req=si&img=7056

https://hrv-club.ru/forums/index.php?autocom=gallery&req=si&img=6937

http://wish-club.ru/forums/index.php?autocom=gallery&req=si&img=5454

http://toyota-porte.ru/forums/index.php?autocom=gallery&req=si&img=3355

http://toyota-porte.ru/forums/index.php?autocom=gallery&req=si&img=3372

http://wish-club.ru/forums/index.php?autocom=gallery&req=si&img=5467

Даня Милохин & Николай Басков – Дико тусим скачать песню бесплатно в mp3 и слушать онлайн https://shorturl.fm/XbLuF

Anivar – Падает Звезда скачать mp3 и слушать онлайн https://shorturl.fm/7ONEA

Денис Майданов – Пролетая над нами скачать бесплатно mp3 и слушать онлайн https://shorturl.fm/PoFcz

Nataliya – Бармен, Налей (Ben Bright Remix) скачать песню в mp3 и слушать онлайн https://shorturl.fm/UNSUE

Подиум – Танцуй, пока молодая скачать песню на телефон и слушать бесплатно https://shorturl.fm/3r6UD

Натали – Новогодние игрушки скачать и слушать онлайн https://shorturl.fm/x60Qi

MC Zali & Julia Lois – Сеньорита скачать песню бесплатно в mp3 и слушать онлайн https://shorturl.fm/J7UxY

Awesome https://shorturl.fm/5JO3e

Cool partnership https://shorturl.fm/a0B2m

Very good partnership https://shorturl.fm/68Y8V

Cool partnership https://shorturl.fm/XIZGD

https://telegra.ph/Istoriya-formata-MP3–revolyuciya-v-mire-cifrovoj-muzyki-03-13

http://passo.su/forums/index.php?autocom=gallery&req=si&img=4256

https://vitz.ru/forums/index.php?autocom=gallery&req=si&img=5071

https://mazda-demio.ru/forums/index.php?autocom=gallery&req=si&img=6358

http://wish-club.ru/forums/index.php?autocom=gallery&req=si&img=5278

https://honda-fit.ru/forums/index.php?autocom=gallery&req=si&img=7147

https://shorturl.fm/A5ni8

https://vitz.ru/forums/index.php?autocom=gallery&req=si&img=5098

https://shorturl.fm/a0B2m

http://wish-club.ru/forums/index.php?autocom=gallery&req=si&img=5355

https://shorturl.fm/bODKa

https://shorturl.fm/9fnIC

https://shorturl.fm/YvSxU

https://shorturl.fm/bODKa

https://shorturl.fm/a0B2m

https://shorturl.fm/YvSxU

https://shorturl.fm/oYjg5

https://shorturl.fm/6539m

https://shorturl.fm/A5ni8

https://shorturl.fm/a0B2m

https://shorturl.fm/9fnIC

https://shorturl.fm/a0B2m

MORGENSHTERN – Новый Мерин скачать песню на телефон и слушать бесплатно https://shorturl.fm/Fqwdb

Sevenrose – Верила скачать песню и слушать бесплатно https://shorturl.fm/dYMGS

Мари Краймбрери – Не Буди Меня скачать песню в mp3 и слушать онлайн https://shorturl.fm/XfcC9

Lx24 – Шаг Вперёд Два Назад скачать mp3 и слушать онлайн https://shorturl.fm/oxY04

Romanova – Караван (ZIIV Remix) скачать mp3 и слушать онлайн бесплатно https://shorturl.fm/fOByR

Dim – Верь Мне скачать песню и слушать онлайн https://shorturl.fm/NFHix

Таисия Повалий – Родина скачать песню и слушать бесплатно https://shorturl.fm/IasUx

Антон Балков – Помадой скачать песню и слушать онлайн https://shorturl.fm/mxaTf

ANSE – Лунатики скачать и слушать песню бесплатно https://shorturl.fm/UdYdk

https://shorturl.fm/oYjg5

https://shorturl.fm/oYjg5

https://shorturl.fm/FIJkD

https://shorturl.fm/9fnIC

https://shorturl.fm/5JO3e

https://shorturl.fm/FIJkD

https://shorturl.fm/j3kEj

https://shorturl.fm/LdPUr

Дмитрий Маликов – Ты одна, ты такая скачать mp3 и слушать бесплатно https://shorturl.fm/aDGqZ

Денис RiDer – Двигаться (Nejtrino & Baur Remix) скачать песню бесплатно в mp3 и слушать онлайн https://shorturl.fm/1y1QJ

Рада Рай Feat. Алексей Петрухин – Рвутся Cтруны скачать песню и слушать бесплатно https://shorturl.fm/O0eCn

Элени – Мирабо скачать бесплатно и слушать онлайн https://shorturl.fm/19yFr

Таисия Повалий – Я знаю, что ты знашь скачать песню на телефон и слушать бесплатно https://shorturl.fm/mYdV7

Эдуард Иконников – Ты Забегай Ко Мне скачать бесплатно mp3 и слушать онлайн https://shorturl.fm/yD0EY

Тамара Кутидзе – Зимняя Ягода скачать и слушать песню бесплатно https://shorturl.fm/sD2UO

Воскресенский – Пацанов Губит Любовь скачать mp3 и слушать онлайн бесплатно https://shorturl.fm/P0qrE

В. Маркин – Колокола скачать mp3 и слушать онлайн https://shorturl.fm/rDDy5

Mseven – Холодное Сердце скачать и слушать онлайн https://shorturl.fm/VZuqS

https://shorturl.fm/TDuGJ

https://shorturl.fm/Xect5

https://shorturl.fm/I3T8M

https://shorturl.fm/IPXDm

https://shorturl.fm/DA3HU

https://shorturl.fm/JtG9d

https://shorturl.fm/MVjF1

https://shorturl.fm/JtG9d

https://shorturl.fm/0oNbA

https://shorturl.fm/fSv4z

https://honda-fit.ru/forums/index.php?autocom=gallery&req=si&img=7050

http://wish-club.ru/forums/index.php?autocom=gallery&req=si&img=5395

https://honda-fit.ru/forums/index.php?autocom=gallery&req=si&img=7326

https://mazda-demio.ru/forums/index.php?autocom=gallery&req=si&img=6514

http://passo.su/forums/index.php?autocom=gallery&req=si&img=4262

http://wish-club.ru/forums/index.php?autocom=gallery&req=si&img=5233

http://terios2.ru/forums/index.php?autocom=gallery&req=si&img=4704

http://terios2.ru/forums/index.php?autocom=gallery&req=si&img=4732

NEEL – Намекаю скачать песню и слушать онлайн

https://allmp3.pro/3282-neel-namekaju.html

Bukatara – Невеста скачать песню и слушать онлайн

https://allmp3.pro/3157-bukatara-nevesta.html

Qiiza – Танцевать в Темноте скачать песню и слушать онлайн

https://allmp3.pro/3284-qiiza-tancevat-v-temnote.html

MATANYA – Пой скачать песню и слушать онлайн

https://allmp3.pro/3012-matanya-poj.html

Reya – Всё Ещё Мне Больно скачать песню и слушать онлайн

https://allmp3.pro/2928-reya-vse-esche-mne-bolno.html

DAASHA – Спать С Тобой скачать песню и слушать онлайн

https://allmp3.pro/2925-daasha-spat-s-toboj.html

ASAFY – Останови скачать песню и слушать онлайн

https://allmp3.pro/2773-asafy-ostanovi.html

Потап и Настя – Голуби скачать песню и слушать онлайн

https://allmp3.pro/2576-potap-i-nastja-golubi.html

OWEEK, Ханза – Вечеринка скачать песню и слушать онлайн

https://allmp3.pro/2565-oweek-hanza-vecherinka.html

Daboguvushi Feat. & Lil Miroir & Mark Wazze – Не Исчезай скачать песню и слушать онлайн

https://allmp3.pro/3150-daboguvushi-feat-lil-miroir-mark-wazze-ne-ischezaj.html

Promote our products and earn real money—apply today! https://shorturl.fm/DzXB1

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/1cF2H

Promote, refer, earn—join our affiliate program now! https://shorturl.fm/B5xB6

Drive sales, earn big—enroll in our affiliate program! https://shorturl.fm/R6XOL

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/zOYg2

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/XN8TN

Earn recurring commissions with each referral—enroll today! https://shorturl.fm/P0iYr

Your influence, your income—join our affiliate network today! https://shorturl.fm/UoDF2

Earn passive income this month—become an affiliate partner and get paid! https://shorturl.fm/1OnkI

Refer friends, earn cash—sign up now! https://shorturl.fm/CZKyy

Become our partner and turn clicks into cash—join the affiliate program today! https://shorturl.fm/Oks7Y

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/TaWXi

Your influence, your income—join our affiliate network today! https://shorturl.fm/bvwuw

Unlock exclusive rewards with every referral—enroll now! https://shorturl.fm/NIZvb

Become our affiliate—tap into unlimited earning potential! https://shorturl.fm/cSFKh

Your influence, your income—join our affiliate network today! https://shorturl.fm/5vTvR

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/FZAY4

Promote our products—get paid for every sale you generate! https://shorturl.fm/fY5RA

Become our partner now and start turning referrals into revenue! https://shorturl.fm/mslTH

Join our affiliate program and watch your earnings skyrocket—sign up now! https://shorturl.fm/yog0V

Apply now and receive dedicated support for affiliates! https://shorturl.fm/5wxvO

Earn up to 40% commission per sale—join our affiliate program now! https://shorturl.fm/bWx1T

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/v73wx

Monetize your audience—become an affiliate partner now! https://shorturl.fm/8vUQa

Promote, refer, earn—join our affiliate program now! https://shorturl.fm/bwzou

Share our offers and watch your wallet grow—become an affiliate! https://shorturl.fm/NblsM

Maximize your earnings with top-tier offers—apply now! https://shorturl.fm/08KQk

Become our partner and turn clicks into cash—join the affiliate program today! https://shorturl.fm/rsBar

Earn recurring commissions with each referral—enroll today! https://shorturl.fm/ZxuMd

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/2Dmcr

Join our affiliate community and earn more—register now! https://shorturl.fm/1Jfq3

Monetize your audience—become an affiliate partner now! https://shorturl.fm/ME5Nq

Share your unique link and cash in—join now! https://shorturl.fm/E0w5f

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/tPI8L

Maximize your income with our high-converting offers—join as an affiliate! https://shorturl.fm/8gctp

Refer customers, collect commissions—join our affiliate program! https://shorturl.fm/DwhcQ

Start sharing our link and start earning today! https://shorturl.fm/Jldon

Earn big by sharing our offers—become an affiliate today! https://shorturl.fm/XVqzo

Monetize your audience with our high-converting offers—apply today! https://shorturl.fm/B8NL4

Earn up to 40% commission per sale—join our affiliate program now! https://shorturl.fm/nJUKK

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/CjmBx

Monetize your audience with our high-converting offers—apply today! https://shorturl.fm/aKClg

Maximize your income with our high-converting offers—join as an affiliate! https://shorturl.fm/4ErMx

Boost your income effortlessly—join our affiliate network now! https://shorturl.fm/IiToT

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/MQHht

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/uGohr

https://shorturl.fm/bNIFR

https://shorturl.fm/u2mR6

https://shorturl.fm/39RmX

https://shorturl.fm/BH31y

https://shorturl.fm/GXypp

https://shorturl.fm/2eilY

https://shorturl.fm/TZ3Kx

https://shorturl.fm/R4maX

https://shorturl.fm/VYur7

https://shorturl.fm/tad7k

https://shorturl.fm/thTr7

https://shorturl.fm/2objB

https://shorturl.fm/KWoxi

https://shorturl.fm/3hXra

https://shorturl.fm/Bs9yl

https://shorturl.fm/jRfi4

https://shorturl.fm/iAX03

https://shorturl.fm/a037O

https://shorturl.fm/3tswR

https://shorturl.fm/1fhTp

https://shorturl.fm/3B8f1

https://shorturl.fm/yfgr8

https://shorturl.fm/hDu2u

https://shorturl.fm/ApHI2

https://shorturl.fm/8wYqS

https://shorturl.fm/S2Zc3

https://shorturl.fm/C0V0g

https://shorturl.fm/lEkh9

https://shorturl.fm/Jayjo

https://shorturl.fm/goDYb

https://shorturl.fm/fLlbl

https://shorturl.fm/efgyl

https://shorturl.fm/cH6Mp

https://shorturl.fm/lJkpH

https://shorturl.fm/9lVkM

https://shorturl.fm/vh9MC

kyohxrkymivoylyvvwphgezwdjlexr

https://shorturl.fm/nLaFp

https://shorturl.fm/KnoqL

https://shorturl.fm/1f690

https://shorturl.fm/46Z2G

https://shorturl.fm/HH3Fz

https://shorturl.fm/XW9M4

https://shorturl.fm/xtrs4

https://shorturl.fm/e1u5a

https://shorturl.fm/1AejS

https://shorturl.fm/Qw3RE

https://shorturl.fm/fYpwn

https://shorturl.fm/mSOIN

https://shorturl.fm/n0rlP

https://shorturl.fm/iNm4U

https://shorturl.fm/veRox

https://shorturl.fm/WLi9V

https://shorturl.fm/vtxl6

https://shorturl.fm/pRX7y

https://shorturl.fm/4HbAa

https://shorturl.fm/VJGyO

https://shorturl.fm/xtyxw

https://shorturl.fm/8fJ7h

https://shorturl.fm/X7NqZ

https://shorturl.fm/fO5OJ

https://shorturl.fm/ov8Ji

https://shorturl.fm/EdIMB

https://shorturl.fm/EdIMB

https://shorturl.fm/sst5U

https://shorturl.fm/me66C

https://shorturl.fm/cbi3R

https://shorturl.fm/gTbQh

https://shorturl.fm/24mu1

https://shorturl.fm/syDSl

https://shorturl.fm/JZ7O3

https://shorturl.fm/l4PoQ

https://shorturl.fm/ShB1U

https://shorturl.fm/IbYxN

https://shorturl.fm/RlPq2

https://shorturl.fm/DxCAC

https://shorturl.fm/YXvkV

https://shorturl.fm/2ca0j

https://shorturl.fm/yyRVs

https://shorturl.fm/iIGyd

https://shorturl.fm/zExDR

https://shorturl.fm/M7iOW

https://shorturl.fm/DeKGp

https://shorturl.fm/fzARs

https://shorturl.fm/uaLAp

https://shorturl.fm/cPAs6

https://shorturl.fm/le5e8

https://shorturl.fm/RUbt4

https://shorturl.fm/jyHQy

https://shorturl.fm/aoBOa

https://shorturl.fm/ySNyX

https://shorturl.fm/lFG7u

https://shorturl.fm/ux3Ch

https://shorturl.fm/z7W4G

https://shorturl.fm/cnVmJ

https://shorturl.fm/uHQRQ

https://shorturl.fm/SOFJQ

https://shorturl.fm/IVDQK

https://shorturl.fm/243Ps

https://shorturl.fm/hrzq1

https://shorturl.fm/Ev2EJ

https://shorturl.fm/tf1jh

https://shorturl.fm/Cybm8

https://shorturl.fm/Khp2P

https://shorturl.fm/RqVcQ

https://shorturl.fm/HBmsy

https://shorturl.fm/0eLYu

https://shorturl.fm/e0TOI

https://shorturl.fm/EpKXz

https://shorturl.fm/6yAtj

https://shorturl.fm/m1emU

https://shorturl.fm/G26oy

https://shorturl.fm/qpuAF

https://shorturl.fm/NED1f

https://shorturl.fm/DjNRJ

https://shorturl.fm/xqSK3

https://shorturl.fm/IzRZl

https://shorturl.fm/AijqH

https://shorturl.fm/G3rgi

https://shorturl.fm/OUqKl

https://shorturl.fm/KZyey

https://shorturl.fm/qRL5o

https://shorturl.fm/1tZ33

https://shorturl.fm/Q82df

https://shorturl.fm/fs7au

https://shorturl.fm/YonyC

https://shorturl.fm/j430W

https://shorturl.fm/M5SmT

https://shorturl.fm/RYaPX

https://shorturl.fm/Nu1qF

https://shorturl.fm/tSQR4

https://shorturl.fm/HLF5B

https://shorturl.fm/73csK

https://shorturl.fm/cnIgJ

https://shorturl.fm/iCGPA

https://shorturl.fm/LWltN

https://shorturl.fm/KD62f

https://shorturl.fm/fpbja

https://shorturl.fm/KrGRs

https://shorturl.fm/QklZw

https://shorturl.fm/T05T7

https://shorturl.fm/sMd4N

https://shorturl.fm/i6143

https://shorturl.fm/QUis6

https://shorturl.fm/5yQdc

https://shorturl.fm/Qiic9

https://shorturl.fm/C83pP

https://shorturl.fm/2ZpHj

https://shorturl.fm/BNS9R

https://shorturl.fm/FfSQW

https://shorturl.fm/ptAnw

https://shorturl.fm/UwVJk

https://shorturl.fm/dpruy

https://shorturl.fm/mO4MR

https://shorturl.fm/IaVGt

https://shorturl.fm/1DZo4

https://shorturl.fm/ByfgH

https://shorturl.fm/tYznJ

https://shorturl.fm/BwKW0

https://shorturl.fm/ZnvX2

https://shorturl.fm/4npvN

https://shorturl.fm/HT6pw

https://shorturl.fm/VMosV

https://shorturl.fm/gZaky

https://shorturl.fm/ollQj

https://shorturl.fm/u8R9m

https://shorturl.fm/QBNWe

https://shorturl.fm/STkwl

https://shorturl.fm/h9Yqx

https://shorturl.fm/vtcoG

https://shorturl.fm/oD9Jm

https://shorturl.fm/3deNo

https://shorturl.fm/aWDAk

https://shorturl.fm/B5YwG

https://shorturl.fm/WMqom

https://shorturl.fm/SCjHx

https://shorturl.fm/5iJhD

https://shorturl.fm/NQjrn

https://shorturl.fm/7XAxo

https://shorturl.fm/k1IOT

https://shorturl.fm/lTHhX

It’s fascinating how gaming evolved in the Philippines, with platforms like BigBuny now prioritizing both entertainment and responsible play. Convenient options like GCash access make it easier to enjoy – check out bigbuny download for a modern experience! A secure, regulated approach is key.

https://shorturl.fm/XwZOe

https://shorturl.fm/eCgiw

https://shorturl.fm/qwzB0

https://shorturl.fm/Hnju0

https://shorturl.fm/uAEgm

https://shorturl.fm/rDbIO

https://shorturl.fm/tbnxt

https://shorturl.fm/kYEG4

https://shorturl.fm/eMeYF

https://shorturl.fm/CG1sX

https://shorturl.fm/AGCPM

https://shorturl.fm/9KRVl

https://shorturl.fm/cqpZs

https://shorturl.fm/ixlQS

https://shorturl.fm/Gq437

https://shorturl.fm/lHVO9

https://shorturl.fm/t3mus

https://shorturl.fm/FVYl4

https://shorturl.fm/VLcSC

https://shorturl.fm/OrqNW

https://shorturl.fm/jTaPh

https://shorturl.fm/nYeHt

https://shorturl.fm/FDkiM

https://shorturl.fm/XHSI1

https://shorturl.fm/RcvaU

https://shorturl.fm/Kbkuj

https://shorturl.fm/3KzZN

https://shorturl.fm/EMHSx

https://shorturl.fm/HF9kd

https://shorturl.fm/RhozF

https://shorturl.fm/8or3L

https://shorturl.fm/XTFUF

https://shorturl.fm/b1vQY

https://shorturl.fm/yIZGV

https://shorturl.fm/pUw5R

https://shorturl.fm/EnI3u

https://shorturl.fm/QhAk8

https://shorturl.fm/v0zd9

https://shorturl.fm/tkdsn

https://shorturl.fm/srHCm

https://shorturl.fm/sMg2I

https://shorturl.fm/0zSNe

https://shorturl.fm/gDemQ

https://shorturl.fm/MEjWj

https://shorturl.fm/dGxW2

https://shorturl.fm/VSzug

https://shorturl.fm/ptcFK

https://shorturl.fm/qvBAB

https://shorturl.fm/T1tU6

https://shorturl.fm/bpLD7

https://shorturl.fm/PkR04

https://shorturl.fm/fEaNq

https://shorturl.fm/8CsbW

https://shorturl.fm/RShF1

Really enjoying this article! The focus on responsible gaming is key. I checked out bigbunny ph link & their quick verification process seems solid – instant deposits are a plus for a smooth experience! 👍

Interesting read! The focus on data analytics to personalize the gaming experience, like with bigbunny ph com, is a smart move. Secure platforms & easy deposits (like GCash!) are key for Filipino players.

https://shorturl.fm/ghwIa

https://shorturl.fm/wKyn9

https://shorturl.fm/v96kl

https://shorturl.fm/FRmYQ

https://shorturl.fm/ZAnXM

https://shorturl.fm/g5udn

https://shorturl.fm/L9F7E

https://shorturl.fm/iqJl7

https://shorturl.fm/LMzIs

https://shorturl.fm/LMzIs

https://shorturl.fm/M1O6t

https://shorturl.fm/qIrdG

That’s a great point about game design impacting player strategy! It’s interesting how platforms like sz777b casino use data to refine the experience-analyzing RTP & patterns could really shift how you play. Definitely food for thought!

Interesting read! Seeing more platforms like sz777b legit focus on data & strategy-it’s not just luck, right? Variance & RTP are key, and responsible play is vital too. Good insights!

https://shorturl.fm/7tl2K

https://shorturl.fm/6fXbu

https://shorturl.fm/KzPm6

https://shorturl.fm/62oCt

https://shorturl.fm/EQ2gy

https://shorturl.fm/K0Gf4

https://shorturl.fm/Y1cqL

https://shorturl.fm/YhMmT

https://shorturl.fm/Ut986

https://shorturl.fm/lJOsm

https://shorturl.fm/x3GDQ

https://shorturl.fm/3JRHN

https://shorturl.fm/1FLF8

https://shorturl.fm/STJSj

https://shorturl.fm/gmiQw

https://shorturl.fm/xW3II

https://shorturl.fm/V7TYi

https://shorturl.fm/nqg9G

https://shorturl.fm/AM6jR

https://shorturl.fm/xCPNy

https://shorturl.fm/m8HEO

https://shorturl.fm/Q2WKO

https://shorturl.fm/NC25Z

https://shorturl.fm/7Mbso

https://shorturl.fm/YHKEw

https://shorturl.fm/oOCnh

https://shorturl.fm/BpQp1

https://shorturl.fm/3hNy3

https://shorturl.fm/1gnWI

https://shorturl.fm/NmEAd

https://shorturl.fm/PqkeA

https://shorturl.fm/T3LG7

https://shorturl.fm/o4PUS

https://shorturl.fm/3DG0b

https://shorturl.fm/fA8Oa

https://shorturl.fm/H0tBJ

https://shorturl.fm/N96Mv

https://shorturl.fm/iHjRY

https://shorturl.fm/jKd0W

Really enjoying this article! The ease of getting started with online gaming is key, and platforms like legend link game seem to get that – quick registration & local payment options are a huge plus for players like me! 👍

That’s a great point about responsible gaming – crucial for enjoying any online platform! It’s awesome to see sites like legend link vip prioritizing ease of use and secure transactions, especially with options like Maya. Fun & safety are a winning combo!

https://shorturl.fm/jKd0W

https://shorturl.fm/yZQAg

https://shorturl.fm/AWYj1

https://shorturl.fm/In7Nh

https://shorturl.fm/wWxZp

https://shorturl.fm/58qQs

https://shorturl.fm/T0Iwu

https://shorturl.fm/U2zDd

https://shorturl.fm/pGs9j

https://shorturl.fm/kJ2C0

https://shorturl.fm/PkyL0

https://shorturl.fm/l2UH4

https://shorturl.fm/vQeb1

https://shorturl.fm/0NDPm

https://shorturl.fm/luzjm

https://shorturl.fm/OcgnZ

https://shorturl.fm/wgPe3

https://shorturl.fm/ayStb

https://shorturl.fm/ggrDG

https://shorturl.fm/NUaTE

https://shorturl.fm/1PEaK

https://shorturl.fm/987eT

https://shorturl.fm/1C46N

https://shorturl.fm/FKbI2

https://shorturl.fm/U2jCt

https://shorturl.fm/Du98y

https://shorturl.fm/xTt7C

https://shorturl.fm/tYnv4

https://shorturl.fm/WI2y3

https://shorturl.fm/ihuOV

https://shorturl.fm/F9i5g

https://shorturl.fm/AVzG5

Great breakdown! It’s fascinating how AI tools like AI Kungfu Video Generator simplify video creation-just upload an image, tweak a few settings, and let the AI do the rest. A smart way to boost engagement without the hassle.

Great tool for turning stills into dynamic video-perfect for boosting engagement without the hassle. I used the AI Hug Video Generator and loved how quick and intuitive it was to create a polished result in minutes.

https://shorturl.fm/6bPvI

https://shorturl.fm/oNY93

https://shorturl.fm/HHAYr

https://shorturl.fm/dQCiH

https://shorturl.fm/k23Pw

https://shorturl.fm/AioaD

https://shorturl.fm/CECc2

https://shorturl.fm/J9IuG

https://shorturl.fm/fzZTr

https://shorturl.fm/nvmlp

https://shorturl.fm/76oPp

https://shorturl.fm/dDvWQ

https://shorturl.fm/IGpL6

https://shorturl.fm/ckdug

Really interesting read! Transparency in online gaming is huge – seeing platforms like orionplay vip publish RTP data is a game changer. Quick registration & local payment options are a big plus too! 👍

Interesting analysis! Seeing platforms like orionplay slot prioritize RTP transparency is a game-changer. Data-driven decisions really matter when handicapping outcomes – both on the track & in the casino! Good read.

https://shorturl.fm/RtuSM

https://shorturl.fm/rjCQV

https://shorturl.fm/V2JZI

https://shorturl.fm/sTg1R

https://shorturl.fm/1nESW

https://shorturl.fm/AXBcb

https://shorturl.fm/7z2hf

https://shorturl.fm/XAbIu

https://shorturl.fm/lW0K0

https://shorturl.fm/eGsWV

https://shorturl.fm/E4Heq

https://shorturl.fm/wiDLV

https://shorturl.fm/T1JYc

https://shorturl.fm/kgLyg

https://shorturl.fm/je6HG

https://shorturl.fm/tnWAA

https://shorturl.fm/ToZZo

https://shorturl.fm/Mfmcs

https://shorturl.fm/oAR2V

https://shorturl.fm/Ia8NH

https://shorturl.fm/uoDFp

https://shorturl.fm/UtQ8f

https://shorturl.fm/EUyDl

https://shorturl.fm/KzFDo

https://shorturl.fm/64TDu

https://shorturl.fm/FKj3w

https://shorturl.fm/DpkiK

Great insights on AI efficiency-AIGO Tools really shines as a go-to hub for vetted solutions. Their curated list of over 500+ tools, like the AI powered options, saves time and boosts productivity for professionals and startups alike.

Exploring AI tools can be overwhelming, but AIGO Tools simplifies the process with curated lists like their AI Accounting Assistant. It’s a great resource for both pros and beginners.

https://shorturl.fm/N99mP

https://shorturl.fm/NmzIr

https://shorturl.fm/v0twT

https://shorturl.fm/PdKxG

https://shorturl.fm/38i2F

https://shorturl.fm/QmCLx

Smart bankroll management is key – seen that emphasized on platforms like LegendLink Maya. It’s not just luck, but strategy! Considering a secure login & funding method? Check out the legendlink maya app download apk for seamless options & a solid experience. Play responsibly!

Analyzing baccarat patterns is key, but a solid platform matters too! I’ve been checking out bossjl – easy registration & a great game selection, especially those slots! Definitely worth a look for serious players. 🧐

RNG analysis is key to fair gaming, and platforms like jl boss seem to understand that with quick registration & secure verification. Exploring options like BossJL slots could be fun, but always prioritize responsible play! 👍

https://shorturl.fm/JqXXc

Interesting points about evolving gaming tech! Seamless access is key – platforms like ylaro legit are making it so much easier to jump in and play, especially with apps & web access. Convenience is a huge win for players!

https://shorturl.fm/HRIZ5

https://shorturl.fm/5JH3t

https://shorturl.fm/uqk8p

https://shorturl.fm/whWw4

https://shorturl.fm/BzBtv

https://shorturl.fm/LpqRQ

https://shorturl.fm/bMBzc

https://shorturl.fm/C7oDn

https://shorturl.fm/yrRqt

https://shorturl.fm/sL5cy

https://shorturl.fm/cq9Wn

https://shorturl.fm/U1x9M

https://shorturl.fm/ruyRd

https://shorturl.fm/35LHu

https://shorturl.fm/CKjcV

https://shorturl.fm/To7Yu

https://shorturl.fm/W8spV

https://shorturl.fm/xvb5b

https://shorturl.fm/lB430

https://shorturl.fm/4JXuq

https://shorturl.fm/wbn7w

https://shorturl.fm/LrPTO

https://shorturl.fm/0JrIx

https://shorturl.fm/vQq4B

https://shorturl.fm/B5Cem

https://shorturl.fm/GCU1I

https://shorturl.fm/1tIr3

https://shorturl.fm/yvChK

https://shorturl.fm/2mVMt

https://shorturl.fm/UBi7n

https://shorturl.fm/IyFO4

https://shorturl.fm/1YH1b

https://shorturl.fm/axOgN

https://shorturl.fm/ZavvF

https://shorturl.fm/f0UR9

https://shorturl.fm/OP17Y

https://shorturl.fm/JxwSi

https://shorturl.fm/XZSSN

https://shorturl.fm/KAheK

https://shorturl.fm/Yc1Oo

https://shorturl.fm/4tq7k

https://shorturl.fm/r8kBc

https://shorturl.fm/OVXdf

https://shorturl.fm/4aIRS

Interesting points about bankroll management! Seeing platforms like jilimk link prioritize legal compliance & security gives players peace of mind – crucial for responsible gaming, especially with age verification. Good article!

It’s fascinating how easily we fall for “near wins” – a key element in keeping players engaged! Seeing that JILIMK prioritizes legal compliance & security (via jilimk app download) is reassuring, especially with online gaming. Responsible platforms are crucial!

https://shorturl.fm/MhB8u

https://shorturl.fm/ZpEEA

https://shorturl.fm/ubb9D

https://shorturl.fm/ZQ8iw

https://shorturl.fm/K8Vin

https://shorturl.fm/xtMrN

https://shorturl.fm/1fpjn

https://shorturl.fm/MVPaB

https://shorturl.fm/jal1d

https://shorturl.fm/OhL5Z

https://shorturl.fm/W5wrT

https://shorturl.fm/7wBzX

Interesting points about maximizing returns – it’s all about informed decisions! Seeing platforms like philslot vip cater to specific markets with localized options is smart. Player satisfaction is key for long-term success, especially with mobile access!

Solid analysis! Seeing more localized platforms like philslot slot download cater to specific markets is smart. Player experience & secure access are key-especially with mobile gaming gaining traction. Good insights here!

Got a game from 1jjgamedownload. It was a faster download than I would’ve thought. Runs smooth so far. Check it here: 1jjgamedownload

https://shorturl.fm/RqTf2

https://shorturl.fm/cc2ku

https://shorturl.fm/gNv5t

https://shorturl.fm/Evqjf

https://shorturl.fm/k1wys

https://shorturl.fm/egvcp

https://shorturl.fm/CJkXG

https://shorturl.fm/6fzTA

https://shorturl.fm/rBIvW

https://shorturl.fm/q6TsN

https://shorturl.fm/6myIz

https://shorturl.fm/RM1xv

https://shorturl.fm/rmGwx

https://shorturl.fm/hxNBB

Just hopped onto bet4bet. Pretty standard stuff, I enjoyed myself. Give em a try when you have the time! Check out bet4bet

https://shorturl.fm/PpWS4

https://shorturl.fm/hkXUG

https://shorturl.fm/S6y6T

Alright folks, 13wim is on my radar. A friend recommended it, said it’s got some unique features. Giving it a whirl and will report back. But so far, so good! Find them here: 13wim

https://shorturl.fm/daFqR

https://shorturl.fm/4fxo8

https://shorturl.fm/DOCzo

https://shorturl.fm/ZXv0z

https://shorturl.fm/aeJWW

https://shorturl.fm/SVsaj

https://shorturl.fm/XO9PF

Phfun21login had some crazy promotions going on when I logged in. Made my deposit go further! See what offers they got: phfun21login

https://shorturl.fm/dPak0

https://shorturl.fm/CVzxK

https://shorturl.fm/dW50h

Fellow Filipinos, registering for Plus777 here in the Philippines is easier than ever. Just go to plus777registerphilippines. Legit and hassle-free para sa ating lahat!

https://shorturl.fm/lkw7G

https://shorturl.fm/tWT8k

https://shorturl.fm/DmMY5

https://shorturl.fm/6a8vk

https://shorturl.fm/6AT21

https://shorturl.fm/frUYd

https://shorturl.fm/0U8aN

https://shorturl.fm/e8ILs

https://shorturl.fm/TUCYM

https://shorturl.fm/njrsS

https://shorturl.fm/Ll93T

https://shorturl.fm/yZSza

https://shorturl.fm/hPX0D

https://shorturl.fm/NBAvl

https://shorturl.fm/8howP

Lodi291login, always a breeze getting in. No frustrating password resets thankfully. Important to have a functional login. Try it here lodi291login.

https://shorturl.fm/YvYAA

https://shorturl.fm/D5EaV

https://shorturl.fm/538Jt

https://shorturl.fm/lOx8Z

https://shorturl.fm/kEqVG

https://shorturl.fm/ZjnDa

https://shorturl.fm/kV1YL

https://shorturl.fm/Yaq21

https://shorturl.fm/PkdzE

https://shorturl.fm/R4DWa

https://shorturl.fm/9tsC8

https://shorturl.fm/4M1Sl

https://shorturl.fm/Zn87B

https://shorturl.fm/uEXgE

https://shorturl.fm/RbvzY

https://shorturl.fm/BWlEu

https://shorturl.fm/HuCQM

https://shorturl.fm/cTtJV

https://shorturl.fm/0Y7pB

https://shorturl.fm/JqEAi

https://shorturl.fm/eCnar

https://shorturl.fm/QqcVV

https://shorturl.fm/3tXfd

https://shorturl.fm/F96Ly

Earn your airdrop on Aster https://is.gd/ZceEI6

Fast indexing of website pages and backlinks on Google https://is.gd/r7kPlC

Fast indexing of website pages and backlinks on Google https://is.gd/r7kPlC

Refer friends and colleagues—get paid for every signup!

Hello https://is.gd/tvHMGJ

Refer friends, earn cash—sign up now!

Join our affiliate program and start earning today—sign up now!

Sign up now and access top-converting affiliate offers!

Promote, refer, earn—join our affiliate program now!

xglzkfqnfzukpquhueznspomhslmvv

Monetize your traffic with our affiliate program—sign up now!

Promote our brand and watch your income grow—join today!

Share your unique link and cash in—join now!

Become our partner and turn referrals into revenue—join now!

Share our products and watch your earnings grow—join our affiliate program!

Join our affiliate program and watch your earnings skyrocket—sign up now!

Share your unique link and earn up to 40% commission!

Join our affiliate program and start earning today—sign up now!

Get paid for every referral—enroll in our affiliate program!

Become our affiliate—tap into unlimited earning potential!

Become our partner and turn clicks into cash—join the affiliate program today!

Unlock exclusive affiliate perks—register now!

Earn passive income on autopilot—become our affiliate!

Become our partner and turn clicks into cash—join the affiliate program today!

Monetize your traffic with our affiliate program—sign up now!

Become our partner and turn referrals into revenue—join now!

Share your link, earn rewards—sign up for our affiliate program!

Drive sales, earn big—enroll in our affiliate program!

Join forces with us and profit from every click!

Interesting points about RNGs and player experience! Seeing platforms like funbingo ph game prioritize localized support & responsible gaming is a smart move for the Philippine market – builds trust, you know? 👍

A really good blog and me back again.

Share our products, reap the rewards—apply to our affiliate program!

Start earning passive income—become our affiliate partner!

Sign up for our affiliate program and watch your earnings grow!

Earn passive income on autopilot—become our affiliate!

Monetize your audience with our high-converting offers—apply today!

Get paid for every referral—sign up for our affiliate program now!

Share our products, earn up to 40% per sale—apply today!

Refer customers, collect commissions—join our affiliate program!

Boost your earnings effortlessly—become our affiliate!

Start earning on autopilot—become our affiliate partner!

Unlock exclusive rewards with every referral—apply to our affiliate program now!

Sign up now and access top-converting affiliate offers!

Share your link and rake in rewards—join our affiliate team!

Share your link, earn rewards—sign up for our affiliate program!

Refer customers, collect commissions—join our affiliate program!

Tap into unlimited earning potential—become our affiliate partner!

Join our affiliate community and start earning instantly!

Promote, refer, earn—join our affiliate program now!